Call: 416-908-2070

Email: [email protected]

Reverse Mortgage

FREE CANADA REVERSE MORTGAGE GUIDE.

This Retirement Strategy is Game-Changing!

As a retiree and homeowner, you are fortunate to have built equity over the years. However, even owning a home may not be enough to shield you from the rising costs and financial challenges that many retirees face today.

We understand that retirement should be a time of security and peace of mind. If you’re facing financial challenges, let’s talk about solutions tailored specifically to help you thrive. Whether it's reducing debt, improving cash flow, or securing the care you need, there are ways to build a more financially stable future in retirement.

Seniors are using the Strategies found in this Interactive eBook to give themselves an edge in achieving a financially secure retirement in just 21 Days.

Our comprehensive eBook offers the latest insights and strategies for integrating reverse mortgages into a responsible and effective retirement plan.

Discover how this powerful tool can boost your financial security, improve your quality of life, and leave a lasting legacy for your loved ones.

Download now to transform your retirement planning and secure a brighter future!

We Respect Your Privacy - No Sales Calls

See why Retirees are Praising this Revolutionary Retirement eBook.

Get Pre-Approved

THOUSANDS OF HOMEOWNERS AGE 55 OR OLDER HAVE REVERSE MORTGAGES

WE SHOP THE BEST REVERSE MORTGAGE PROVIDER

GET YOUR FREE NO-OBLIGATION PRE-APPROVAL TO FIND OUT HOW MUCH YOU QUALIFY FOR.

Easy To Qualify

NO MORTGAGE PAYMENTS EVER!

IMPROVE YOUR HOUSEHOLD CASH FLOW TO ENJOY A BETTER AND STRESS FREE LIFESTYLE

APPROVAL BASED ON HOME EQUITY ONLY

INCOME OR GOOD ENOUGH CREDIT? DOESN’T MATTER

HOME EQUITY LOAN – REVERSE MORTGAGE

GUARANTEED & DESIGNED TO HELP HOMEOWNERS AGE 55 OR OLDER

BETTER THAN ANY HOME EQUITY LINE OF CREDIT

GET FRIENDLY UNBIASED OPINION FROM A LICENSED REVERSE MORTGAGE BROKER!

Got Questions?

SPEAK TO

FRIENDLY & HELPFUL

MATTHEW HINES

Canada’s Expert

PROVIDING UNBIASED OPINION

TO IMPROVE YOUR LIFESTYLE, INCOME AND HAPPINESS

416-908-2070

Discover the Power of a Reverse Mortgage!

Access Up to 55% of Your Home Equity

Homeowners in Canada aged 55+ can tap into their home equity with a reverse mortgage, unlocking up to 55% (up to 65% in some circumstances) of their home’s value. No monthly payments are required, and the loan only needs to be repaid when you sell your home, move out permanently, or the last survivor passes away.

What a Reverse Mortgage REALLY IS

A reverse mortgage is more than just a loan; it’s a financial tool that provides added security and flexibility for retirees. When used correctly, it can be a game-changer, offering an edge in achieving financial stability. Boost your financial security, enhance your quality of life, and ensure a lasting legacy for your loved ones.

Versatile and Tax-Free Funds

You can use the money from a reverse mortgage for any purpose, whether it’s a lump sum, installments, or a combination. Best of all, the funds you receive are tax-free. Receive tax-free funds from your home’s equity to cover expenses like debt, renovations, or day-to-day costs, without impacting your government benefits.

Beyond CHIP Reverse Mortgage

Most people have heard of the CHIP Reverse Mortgage offered by HomeEquity Bank, but there are other lenders out there as well.

No More Mortgage Payments

Enjoy the freedom of being mortgage payment-free. A reverse mortgage allows you to stop making monthly payments while still owning your home.

Flexible Financial Options

Choose how to receive your funds—whether as a lump sum, occasionally as needed, scheduled monthly payments, or a combination — based on your financial needs and goals.

Preserve Home Ownership

Keep full ownership of your home while living in it, with the flexibility to sell or refinance at any time. You maintain control over your property and equity growth.

Secure Your Future and Legacy

Reverse mortgages allow you to live comfortably and potentially pass on wealth to your heirs by leveraging home equity to build a tax-free savings plan or fund an early inheritance.

Stay in Your Home for Life

With a reverse mortgage, you are guaranteed the right to live in your home for as long as you wish, or until the last surviving homeowner passes away, without fear of eviction or foreclosure.

No Credit or Income Requirements

Unlike traditional loans, reverse mortgages don’t require proof of income or creditworthiness, making them accessible for retirees with limited financial resources.

Protect Against Market Fluctuations

Reverse mortgages provide a steady source of income that isn’t affected by stock market volatility, ensuring stability and peace of mind during retirement.

Preserve Investments

A reverse mortgage allows you to tap into home equity without having to liquidate your other retirement savings or investments, helping to protect your financial future.

Eliminate High-Interest Debt

A reverse mortgage can help you pay off high-interest credit card debt or other loans, improving your financial situation by lowering your monthly expenses.

Flexible Repayment Options

You are in control of repayment. You can choose to make no payments, partial payments, or full interest payments, giving you flexibility based on your financial situation.

No Impact on Government Benefits

Reverse mortgage proceeds do not affect eligibility for Canadian government benefits like CPP, OAS, GIS, or other pensions, allowing you to maintain your full entitlements.

Enjoy a Better Quality of Life

Use the additional cash flow to improve your lifestyle—travel, pursue hobbies, or engage in social activities that may have previously been out of reach.

Reverse Mortgage Learning Centre

In-depth articles, written by our in-house experts that help you understand everything you need to know about Reverse Mortgages in Canada.

Thriving on a Fixed Income in Retirement: A Financial Professional's Guide

Retirement ushers in a new phase where the steady paychecks of your working years are replaced by fixed income sources. While this change requires adjustment, strategic planning and disciplined financial habits can ensure you continue to enjoy life. Here’s a comprehensive guide to help you navigate this transition and make the most of your golden years.

Eliminate Debts Aggressively

In the lead-up to retirement, it's crucial to tackle any outstanding debts. Adopt a frugal lifestyle, focusing on essential expenses such as your mortgage, groceries, utilities, and insurance. Use the savings to pay down debts, particularly high-interest ones like car loans. Consider trading in a newer vehicle for a more affordable, used model to eliminate car payments.

Build an Emergency Fund

Having an emergency fund is essential to manage unexpected expenses, which can be challenging to handle on a fixed income. Aim to save at least $1,000, and preferably more, in a high-yield savings account. This will provide a financial cushion for emergencies like medical bills or car repairs without resorting to credit.

Minimize Credit Card Use

To avoid new debt, limit your use of credit cards. Keep just one for emergencies and rely on cash or debit cards for daily expenses. This approach helps prevent debt accumulation that could strain your financial resources.

Downsize Your Home or Find a Roommate

Many retirees live in larger homes that are no longer needed once children have moved out. Downsizing to a smaller, more manageable home can reduce mortgage payments and maintenance costs. If downsizing isn’t an option, consider renting out a room to generate additional income. A compatible roommate can share living expenses, easing your financial burden.

Relocate to Tax-Friendly States

Consider moving to a state with favorable tax policies for retirees. Some states do not tax Social Security benefits and have lower living costs. For example, Texas has no state income tax, which can significantly ease financial pressure in retirement.

Cook at Home

Dining out frequently can quickly drain your finances. Save money by preparing meals at home and buying groceries in bulk. Use coupons to stock up on essentials and explore budget-friendly recipes. This simple change can save you thousands of dollars annually.

Enjoy Low-Cost Leisure Activities

Socializing and entertainment don’t have to be expensive. Spend quality time with family and friends at home or in local parks. Host gatherings or engage in low-cost activities like backyard games. This approach creates meaningful experiences without straining your budget.

Explore Side Hustles

Boost your fixed income with a side hustle. Opportunities are plentiful, from driving for rideshare services like Uber or Lyft to freelance work online. Pet-sitting or dog-walking are also popular, especially in neighborhoods with busy professionals. A side hustle not only supplements your income but also keeps you active and engaged.

Consider a Reverse Mortgage

For homeowners aged 55 and over, a reverse mortgage can be a strategic way to access additional funds. This financial product allows you to convert part of your home equity into cash without selling your home. The funds can be used to cover living expenses, pay off debts, or even finance travel and leisure activities. A reverse mortgage can provide a steady income stream, making it easier to manage finances on a fixed income.

Conclusion

Retirement on a fixed income requires careful planning and disciplined spending, but it doesn’t mean you have to compromise your quality of life. By eliminating debts, building an emergency fund, minimizing credit card use, downsizing your home, considering a reverse mortgage, and finding affordable leisure activities and side hustles, you can ensure financial stability and enjoy a fulfilling retirement. With thoughtful planning and smart financial choices, you can make the most of your golden years.

STILL NOT SURE?

Frequently Asked Questions

Find answers to common questions we receive about Reverse Mortgages in Canada

What is a reverse mortgage, and how does it work?

A reverse mortgage allows Canadian homeowners aged 55+ to access a portion of their home’s equity as tax-free cash—without making monthly mortgage payments. The loan is repaid when you sell your home, move out, or pass away.

Do I still own my home?

Yes! You remain the owner, and you can live in your home for as long as you like, provided you meet the loan conditions (such as paying property taxes and insurance and maintaining the home). It is just a mortgage. When you first purchased your home and you received a loan from your bank, you did not give up ownership of your home. It is the same with a reverse mortgage.

How much money can I receive?

The amount depends on your age, home value, type of home, location, and lender. Generally, the older you are and the more your home is worth, the more you can borrow. To find out how much you could borrow, request a no-obligation pre-approval.

Do I need to make monthly payments?

No. One of the biggest advantages of a reverse mortgage is that you don’t have to make monthly payments. The loan balance grows over time, and it is repaid when you sell your home or pass away.

Will my children or heirs inherit my home?

Yes, your home can still be passed on to your heirs. However, they will need to repay the reverse mortgage balance, usually by selling the home or using other funds. Any remaining home equity belongs to them.

What are the costs of a reverse mortgage?

While there are no monthly payments, interest accrues over time. There are also setup costs, such as legal fees, an appraisal fee, and a one-time closing fee. On average, the cost for setting up a reverse mortgage is $3,000 - deducted from proceeds. The appraisal cost is the only out of pocket cost and some lenders will cover this for you upfront.

Can I use the money however I want?

Yes! Many retirees use reverse mortgage funds to eliminate existing mortgage or debt payments, cover medical expenses, supplement their retirement income, or even help their children or grandchildren financially.

How does a reverse mortgage compare to a Home Equity Line of Credit (HELOC)?

A HELOC requires monthly payments and an income qualification, while a reverse mortgage does not. Many retirees find it difficult to qualify for a HELOC due to fixed retirement income, making a reverse mortgage a more accessible option.

Can I sell my home if I have a reverse mortgage?

Yes! You can sell your home at any time, and the reverse mortgage will be repaid from the proceeds of the sale. Any remaining equity is yours to keep. Remember, you always retain ownership of your home with all the rights and responsibilities.

Is a reverse mortgage the right choice for me?

If you want to access home equity without selling or making payments, a reverse mortgage can be a great option. However, it’s important to consider long-term costs and explore all financial options. Speaking with a mortgage professional can help you decide. At anytime, you can schedule a free, no-obligation consultation with me.

What happens if I move into long-term care?

If you move into a nursing home or assisted living for an extended period (typically 12 months or more), the reverse mortgage must be repaid. Many retirees use reverse mortgage funds to cover care costs so they can stay in their homes longer. or use a Home Equity Tax-Free Annuity to cover the cost of homecare.

How does interest work on a reverse mortgage?

Interest accumulates on the loan balance over time. Since you’re not making monthly payments, the total amount owed grows. The final amount is paid off when the home is sold.

Can I get a reverse mortgage if I still have a regular mortgage?

Yes! Many retirees use a reverse mortgage to pay off their existing mortgage, eliminating monthly mortgage payments and freeing up their cash flow.

Are reverse mortgage proceeds taxable?

No, the money you receive from a reverse mortgage is not taxable income. It does not affect your Old Age Security (OAS), Canada Pension Plan or Guaranteed Income Supplement (GIS) benefits.

How do I get started?

The first step is to speak with a reverse mortgage specialist. They will review your financial situation, explain the options, and help you determine if a reverse mortgage is right for you.

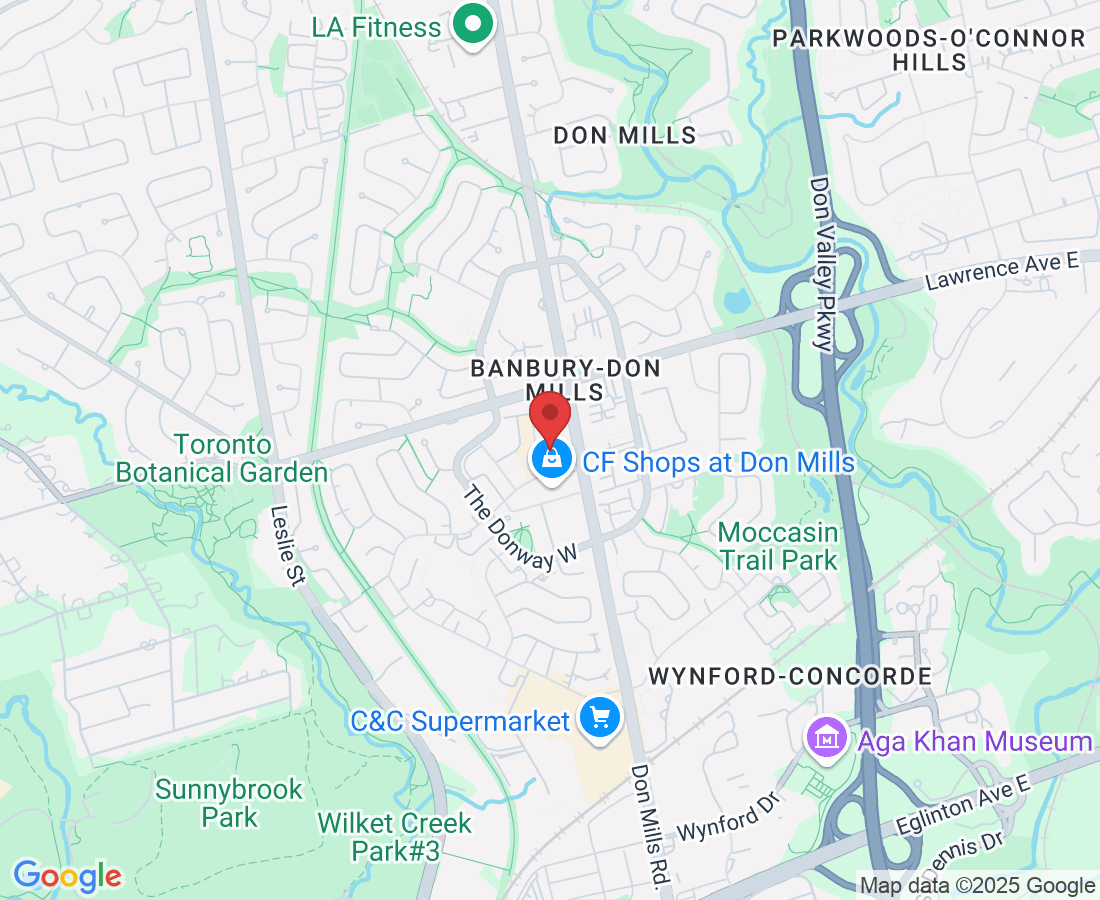

Locations:

*Located inside the Royal LePage Signature Realty Offices.