Call: 416-908-2070

Email: [email protected]

Reverse Mortgage

FREE CANADA REVERSE MORTGAGE GUIDE.

This Retirement Strategy is Game-Changing!

As a retiree and homeowner, you are fortunate to have built equity over the years. However, even owning a home may not be enough to shield you from the rising costs and financial challenges that many retirees face today.

We understand that retirement should be a time of security and peace of mind. If you’re facing financial challenges, let’s talk about solutions tailored specifically to help you thrive. Whether it's reducing debt, improving cash flow, or securing the care you need, there are ways to build a more financially stable future in retirement.

Seniors are using the Strategies found in this Interactive eBook to give themselves an edge in achieving a financially secure retirement in just 21 Days.

Our comprehensive eBook offers the latest insights and strategies for integrating reverse mortgages into a responsible and effective retirement plan.

Discover how this powerful tool can boost your financial security, improve your quality of life, and leave a lasting legacy for your loved ones.

Download now to transform your retirement planning and secure a brighter future!

We Respect Your Privacy - No Sales Calls

See why Retirees are Praising this Revolutionary Retirement eBook.

Get Pre-Approved

THOUSANDS OF HOMEOWNERS AGE 55 OR OLDER HAVE REVERSE MORTGAGES

WE SHOP THE BEST REVERSE MORTGAGE PROVIDER

GET YOUR FREE NO-OBLIGATION PRE-APPROVAL TO FIND OUT HOW MUCH YOU QUALIFY FOR.

Easy To Qualify

NO MORTGAGE PAYMENTS EVER!

IMPROVE YOUR HOUSEHOLD CASH FLOW TO ENJOY A BETTER AND STRESS FREE LIFESTYLE

APPROVAL BASED ON HOME EQUITY ONLY

INCOME OR GOOD ENOUGH CREDIT? DOESN’T MATTER

HOME EQUITY LOAN – REVERSE MORTGAGE

GUARANTEED & DESIGNED TO HELP HOMEOWNERS AGE 55 OR OLDER

BETTER THAN ANY HOME EQUITY LINE OF CREDIT

GET FRIENDLY UNBIASED OPINION FROM A LICENSED REVERSE MORTGAGE BROKER!

Got Questions?

SPEAK TO

FRIENDLY & HELPFUL

MATTHEW HINES

Canada’s Expert

PROVIDING UNBIASED OPINION

TO IMPROVE YOUR LIFESTYLE, INCOME AND HAPPINESS

416-908-2070

Discover the Power of a Reverse Mortgage!

Access Up to 55% of Your Home Equity

Homeowners in Canada aged 55+ can tap into their home equity with a reverse mortgage, unlocking up to 55% (up to 65% in some circumstances) of their home’s value. No monthly payments are required, and the loan only needs to be repaid when you sell your home, move out permanently, or the last survivor passes away.

What a Reverse Mortgage REALLY IS

A reverse mortgage is more than just a loan; it’s a financial tool that provides added security and flexibility for retirees. When used correctly, it can be a game-changer, offering an edge in achieving financial stability. Boost your financial security, enhance your quality of life, and ensure a lasting legacy for your loved ones.

Versatile and Tax-Free Funds

You can use the money from a reverse mortgage for any purpose, whether it’s a lump sum, installments, or a combination. Best of all, the funds you receive are tax-free. Receive tax-free funds from your home’s equity to cover expenses like debt, renovations, or day-to-day costs, without impacting your government benefits.

Beyond CHIP Reverse Mortgage

Most people have heard of the CHIP Reverse Mortgage offered by HomeEquity Bank, but there are other lenders out there as well.

No More Mortgage Payments

Enjoy the freedom of being mortgage payment-free. A reverse mortgage allows you to stop making monthly payments while still owning your home.

Flexible Financial Options

Choose how to receive your funds—whether as a lump sum, occasionally as needed, scheduled monthly payments, or a combination — based on your financial needs and goals.

Preserve Home Ownership

Keep full ownership of your home while living in it, with the flexibility to sell or refinance at any time. You maintain control over your property and equity growth.

Secure Your Future and Legacy

Reverse mortgages allow you to live comfortably and potentially pass on wealth to your heirs by leveraging home equity to build a tax-free savings plan or fund an early inheritance.

Stay in Your Home for Life

With a reverse mortgage, you are guaranteed the right to live in your home for as long as you wish, or until the last surviving homeowner passes away, without fear of eviction or foreclosure.

No Credit or Income Requirements

Unlike traditional loans, reverse mortgages don’t require proof of income or creditworthiness, making them accessible for retirees with limited financial resources.

Protect Against Market Fluctuations

Reverse mortgages provide a steady source of income that isn’t affected by stock market volatility, ensuring stability and peace of mind during retirement.

Preserve Investments

A reverse mortgage allows you to tap into home equity without having to liquidate your other retirement savings or investments, helping to protect your financial future.

Eliminate High-Interest Debt

A reverse mortgage can help you pay off high-interest credit card debt or other loans, improving your financial situation by lowering your monthly expenses.

Flexible Repayment Options

You are in control of repayment. You can choose to make no payments, partial payments, or full interest payments, giving you flexibility based on your financial situation.

No Impact on Government Benefits

Reverse mortgage proceeds do not affect eligibility for Canadian government benefits like CPP, OAS, GIS, or other pensions, allowing you to maintain your full entitlements.

Enjoy a Better Quality of Life

Use the additional cash flow to improve your lifestyle—travel, pursue hobbies, or engage in social activities that may have previously been out of reach.

Reverse Mortgage Learning Centre

In-depth articles, written by our in-house experts that help you understand everything you need to know about Reverse Mortgages in Canada.

The Taxation of Reverse Mortgages in Canada: Key Insights for Homeowners

A reverse mortgage can be a powerful financial tool for Canadian homeowners aged 55 or older, offering the flexibility to access home equity without making monthly payments. However, the tax implications are often a key consideration for those exploring this option. In this blog, we’ll take a closer look at the tax benefits and obligations of reverse mortgages in Canada, how they impact estate planning, and their effect on government benefits. By understanding these factors, homeowners can make informed decisions for their financial future.

Tax-Free Retirement Income

One of the most compelling aspects of a reverse mortgage is that the funds received are not considered taxable income. Unlike other forms of retirement income, such as withdrawals from an RRSP or RRIF, the money from a reverse mortgage is classified as a loan. This means homeowners can access cash from their home’s equity without increasing their tax burden or by reducing dependence on other forms of taxable retirement income, providing a tax-efficient way to supplement retirement income.

Property Taxes and Reverse Mortgages

While reverse mortgage funds themselves are not taxed, homeowners must still fulfill certain tax obligations related to their property. In British Columbia, homeowners over 55 can defer property taxes, even if they have a reverse mortgage. However, in Alberta, seniors who defer property taxes cannot use the program if they already have a reverse mortgage in place. This distinction is important for those looking to leverage their home equity while minimizing out-of-pocket expenses.

Estate Planning Considerations

Reverse mortgages can also play a role in estate planning, particularly when it comes to reducing potential estate tax liabilities. By decreasing the value of the estate through a reverse mortgage, heirs may face lower estate taxes when the home is passed on. Additionally, since the loan is repaid only when the home is sold or the homeowner passes away, reverse mortgages provide a way to maintain liquidity during retirement without disrupting estate planning goals.

Impact on Government Benefits

Many homeowners are concerned about how reverse mortgage income might impact government benefits, such as Old Age Security (OAS), the Guaranteed Income Supplement (GIS), or Canada Pension Plan (CPP) payments. Fortunately, because reverse mortgage funds are considered a loan, they do not count as taxable income and thus do not affect eligibility for these benefits. However, homeowners should consult with a financial advisor to understand how provincial social assistance programs might assess home ownership or reverse mortgage proceeds in their calculations.

Reverse Mortgage Interest and Tax Deductibility

While the proceeds from a reverse mortgage are tax-free, the interest on the loan is generally not tax-deductible for personal income tax purposes. However, if the funds are invested in income-generating assets, some portion of the interest may be deductible. Consulting with a tax professional is highly recommended to navigate these nuances.

Protecting Your Financial Future

Reverse mortgages offer a unique, tax-efficient way to access home equity and supplement retirement income. However, homeowners should carefully consider the tax implications, as well as the impact on their estate and government benefits. Engaging with a financial advisor or tax expert is essential to developing a strategy that aligns with both short-term financial needs and long-term goals.

Are you ready to explore how a reverse mortgage could work for your retirement? Whether you're looking to reduce your tax burden, increase your cash flow, or plan for a secure financial future, we can help. Contact us today to learn more about how a reverse mortgage can fit into your retirement strategy.

STILL NOT SURE?

Frequently Asked Questions

Find answers to common questions we receive about Reverse Mortgages in Canada

What is a reverse mortgage, and how does it work?

A reverse mortgage allows Canadian homeowners aged 55+ to access a portion of their home’s equity as tax-free cash—without making monthly mortgage payments. The loan is repaid when you sell your home, move out, or pass away.

Do I still own my home?

Yes! You remain the owner, and you can live in your home for as long as you like, provided you meet the loan conditions (such as paying property taxes and insurance and maintaining the home). It is just a mortgage. When you first purchased your home and you received a loan from your bank, you did not give up ownership of your home. It is the same with a reverse mortgage.

How much money can I receive?

The amount depends on your age, home value, type of home, location, and lender. Generally, the older you are and the more your home is worth, the more you can borrow. To find out how much you could borrow, request a no-obligation pre-approval.

Do I need to make monthly payments?

No. One of the biggest advantages of a reverse mortgage is that you don’t have to make monthly payments. The loan balance grows over time, and it is repaid when you sell your home or pass away.

Will my children or heirs inherit my home?

Yes, your home can still be passed on to your heirs. However, they will need to repay the reverse mortgage balance, usually by selling the home or using other funds. Any remaining home equity belongs to them.

What are the costs of a reverse mortgage?

While there are no monthly payments, interest accrues over time. There are also setup costs, such as legal fees, an appraisal fee, and a one-time closing fee. On average, the cost for setting up a reverse mortgage is $3,000 - deducted from proceeds. The appraisal cost is the only out of pocket cost and some lenders will cover this for you upfront.

Can I use the money however I want?

Yes! Many retirees use reverse mortgage funds to eliminate existing mortgage or debt payments, cover medical expenses, supplement their retirement income, or even help their children or grandchildren financially.

How does a reverse mortgage compare to a Home Equity Line of Credit (HELOC)?

A HELOC requires monthly payments and an income qualification, while a reverse mortgage does not. Many retirees find it difficult to qualify for a HELOC due to fixed retirement income, making a reverse mortgage a more accessible option.

Can I sell my home if I have a reverse mortgage?

Yes! You can sell your home at any time, and the reverse mortgage will be repaid from the proceeds of the sale. Any remaining equity is yours to keep. Remember, you always retain ownership of your home with all the rights and responsibilities.

Is a reverse mortgage the right choice for me?

If you want to access home equity without selling or making payments, a reverse mortgage can be a great option. However, it’s important to consider long-term costs and explore all financial options. Speaking with a mortgage professional can help you decide. At anytime, you can schedule a free, no-obligation consultation with me.

What happens if I move into long-term care?

If you move into a nursing home or assisted living for an extended period (typically 12 months or more), the reverse mortgage must be repaid. Many retirees use reverse mortgage funds to cover care costs so they can stay in their homes longer. or use a Home Equity Tax-Free Annuity to cover the cost of homecare.

How does interest work on a reverse mortgage?

Interest accumulates on the loan balance over time. Since you’re not making monthly payments, the total amount owed grows. The final amount is paid off when the home is sold.

Can I get a reverse mortgage if I still have a regular mortgage?

Yes! Many retirees use a reverse mortgage to pay off their existing mortgage, eliminating monthly mortgage payments and freeing up their cash flow.

Are reverse mortgage proceeds taxable?

No, the money you receive from a reverse mortgage is not taxable income. It does not affect your Old Age Security (OAS), Canada Pension Plan or Guaranteed Income Supplement (GIS) benefits.

How do I get started?

The first step is to speak with a reverse mortgage specialist. They will review your financial situation, explain the options, and help you determine if a reverse mortgage is right for you.

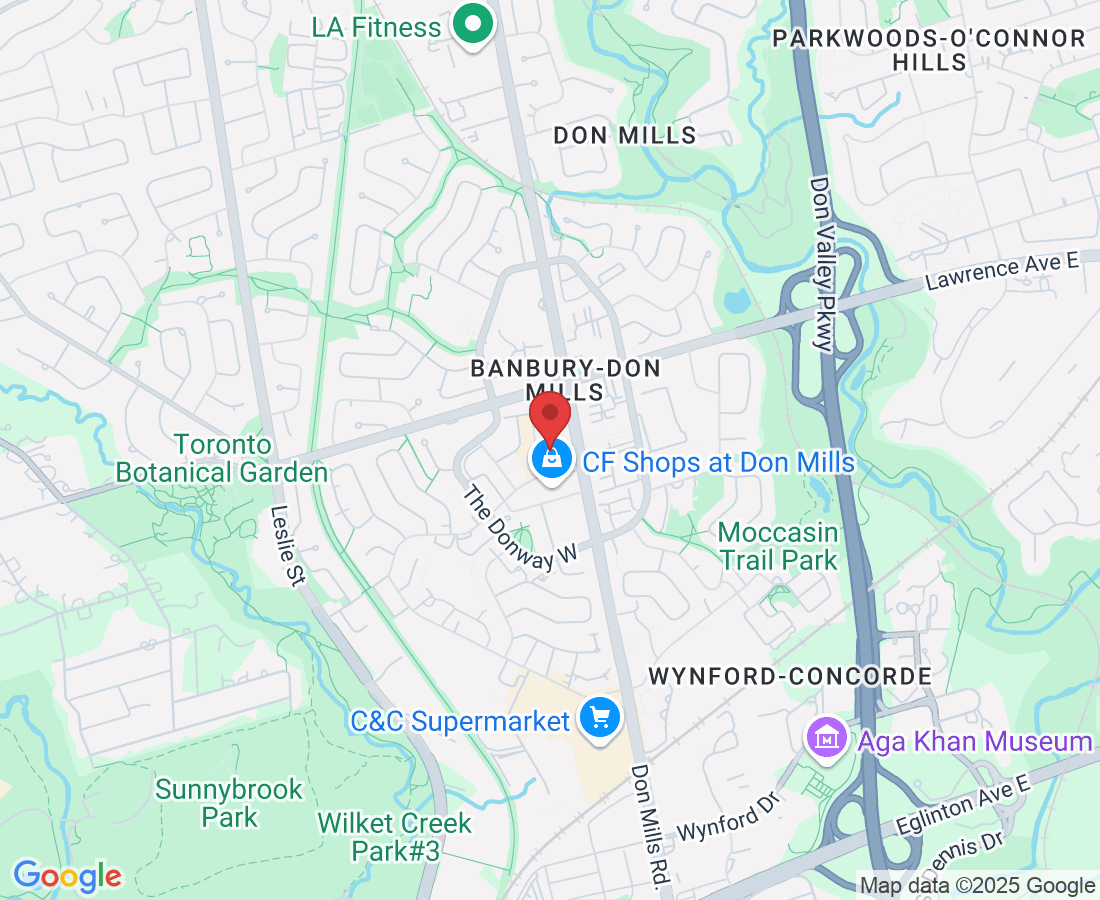

Locations:

*Located inside the Royal LePage Signature Realty Offices.